In this era of digital connectivity, money transfers across borders should no longer be a challenge. The process should be as straightforward as sending a text message. Paysend is an innovative global money transfer service, and it is set to make this dream a reality.

What is Paysend?

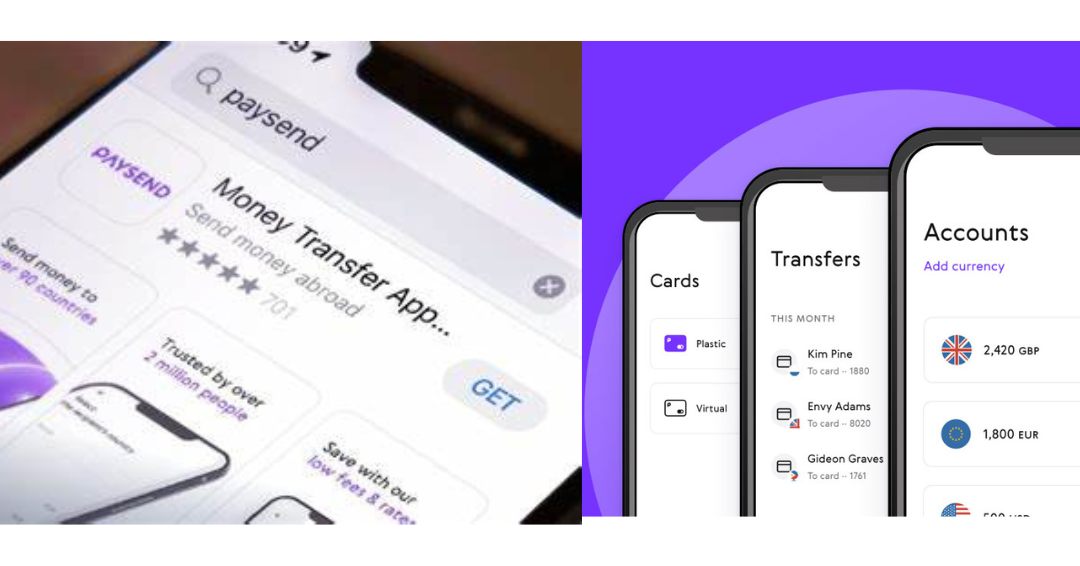

Paysend was founded in the UK in 2017 and is a pioneering online money transfer platform. A team of experts launched the platform, and it identifies itself as a global Fintech company on a mission to change how money is moved around the world. Paysend has developed a fast, simple money transfer system, acquiring over 4 million customers and 17,000 small and medium-sized businesses globally. The service allows users to conveniently send money from their credit or debit cards directly to their bank accounts, Paysend prepaid cards, or digital wallets. This is in more than 90 countries worldwide.

Since Paysend was founded on the ethos of speed, security, and simplicity, it is committed to making global money transfers effortless. It connects millions of people globally with its easy-to-use service.

Key benefits

Paysend is outstanding among dozens of online money transfer services. These are the main benefits that make it unique.

Simplicity:

Paysend is a straightforward, user-friendly platform that makes sending money online a breeze. All you require are the recipient’s details – name, and bank account number – to initiate a transfer.

Speed:

We are used to traditional wire transfers that take several days to complete a transaction. Paysend processes transfer within minutes. This fast transfer speed is a game-changer for people who need to send money urgently.

Security:

Paysend adheres to strict safety standards when transferring funds. The service is licensed and regulated by the UK’s Financial Conduct Authority (FCA), confirming its commitment to reliability and trustworthiness.

Global Reach:

Paysend facilitates transfers to over 90 countries worldwide. This extensive reach provides an efficient and convenient solution for those with international financial obligations, such as supporting family members overseas or managing business transactions.

Fee

Paysend is also convenient and cost-effective. The platform offers a flat fee structure. You will be charged a constant fee of $2/€2/£2 for each transaction, regardless of the amount you want to transact. There are no additional fees. The rates in this pricing strategy can result in significant savings, particularly when you want to do larger transfers where percentage-based charges could accumulate.

However, please note that even if Paysend does not charge a currency exchange markup, your bank may charge you fees for each transaction or apply a different exchange rate.

How to Send Money Online with Paysend

Transferring money with paysend is quick and easy. The steps are:

1. Create an account: Visit the Paysend website, download the mobile app, and register as a first-time user.

2. Start a transfer: Enter the recipient’s name, bank account details, and the amount you want to send. Paysend will display the flat transfer fee and the exchange rate before you complete the transaction.

3. Make a payment: Pay for your transfer using a debit or credit card. Paysend accepts cards from over 50 countries worldwide.

4. Track your transfer: You can track its progress through your Paysend account once it is underway.

Customer support

Paysend provides strong customer support that ensures uninterrupted customer service. Customer support is available 24/7 through the app or live chat on their website. You can also reach the support team by email. Besides, you can check out their extensive FAQ section on their website to get immediate answers to commonly asked questions.

Article source

Transfer money online globally from Canada for only £1, $2 or €1.5 | Paysend Global Transfers